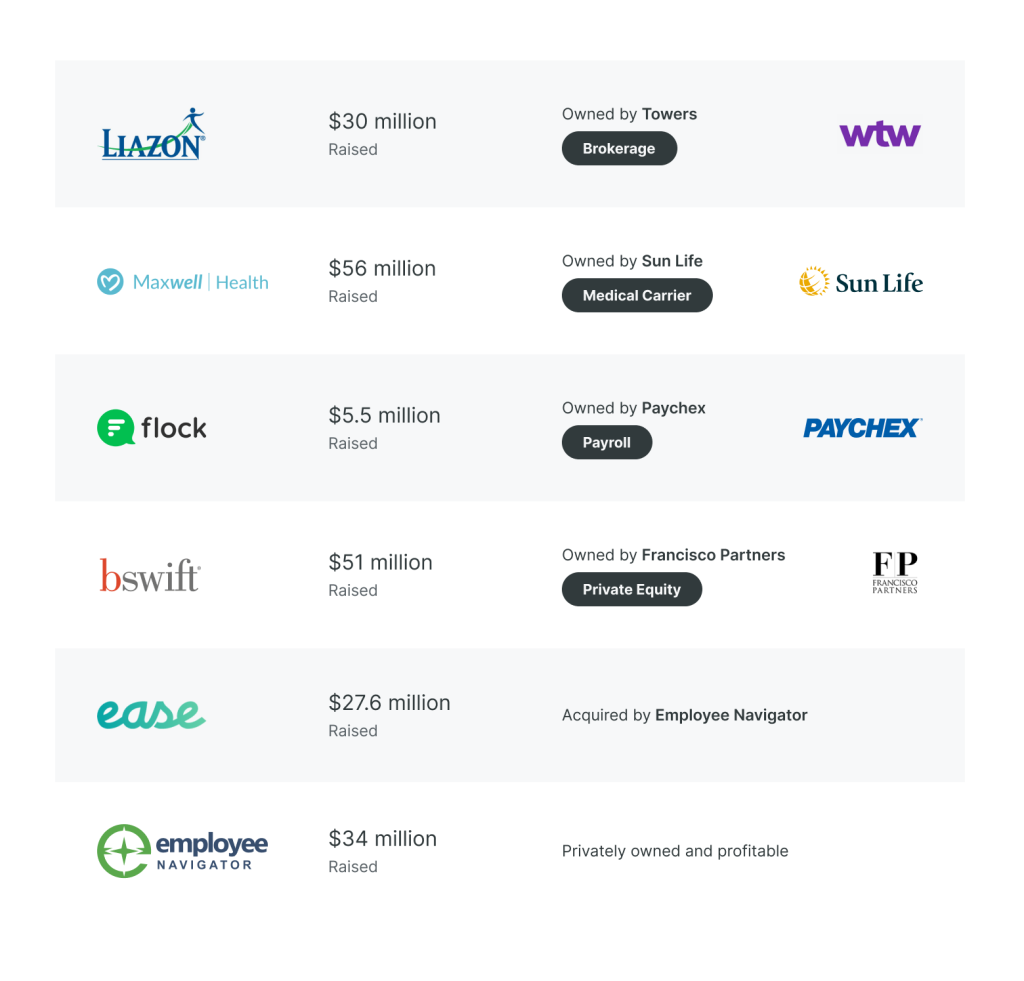

Liazon, Maestro, Flock and Maxwell Health are familiar names to insurance brokers and carriers that have used benefits administration technology over the last decade. However, as of 2024, these companies either have a reduced market footprint or have ceased operations all together. Far from celebrating their downward trajectory, I have listened to countless customers describe the pain of losing clients to oversold software systems. While this might seem like a new phenomenon, the modernization of the benefits administration marketplace seems eerily similar to the transformation of 401(k) administration in the ‘80s and ‘90s.

Employee Navigator has been dedicated to building a company that can be a long-term partner for brokers and carriers. To do so it’s important to understand that raising money from private equity firms, a common characteristic of benefits administration companies, can negatively impact a business’s trajectory and the customers they serve. Employee Navigator has deliberately journeyed down a path less traveled to avoid a similar fate.

The interests of investors don’t always align with long-term relationships that are the lifeblood of insurance brokers and their customers. Companies that fund losses by raising institutional money are forced to grow faster to justify these losses and their ever-expanding valuations. There are some outliers that can walk this fine line and build large sustainable businesses, but their track record in benefits administration is mixed at best. A focus on expansion over profitability and prioritizing short-term gains over building essential, long-term infrastructure manifests itself in a variety of ways that knowledgeable insurance carriers and brokers can readily identify such as:

- Overpromising capabilities during sales pitches, relying on manual work rather than scalable and automated solutions.

- Sales teams focused on software changes to sell a “deal” rather than addressing core operational challenges.

- Pursuing revenue growth by locking customers into lengthy contracts to achieve short-term financial gains.

- Bringing in new leadership dictated by private equity firms who are financially incentivized to run the business for a short period of time, say 3-5 years, only to then sell the company.

- Problematic exit strategies that have often disadvantaged customers, particularly when companies sell themselves into situations of channel conflict as seen with bSwift’s sale to Aetna or Liazon’s sale to Towers Watson. If you’re a broker, would you want to put your clients on a system owned by another broker? If you’re an insurance carrier, would you want to invest in an integration with a platform owned by another carrier?

We recommend asking the tough questions.

- What is the exit strategy for the owners of the business?

- Can your customers choose to integrate with any payroll system?

- Are operations and data management outsourced overseas?

- Does the benefits administration system own the data connection to the carrier, or do they use an intermediary? How much do you know about this intermediary?

- Can you terminate your agreement at any time?

- Is the benefits administrator themselves a licensed insurance broker and consuming part of your compensation?

- Which functions are automated versus performed by people?

- Who has the majority control of the board?

- Do the owners and executives understand insurance? Does the executive team have a track record of jumping companies? Can they be trusted as a long-term partner for your agency?

- What growth targets are set and how much of that will come from fee increases?

Employee Navigator is not immune to these criticisms and risks; however, we have taken deliberate steps to ensure we can make the necessary investments to be a stable, long-term partner for our customers.

- As Founder and CEO, I maintain control over our board, prioritizing long-term strategic objectives over immediate gains. This approach contrasts with many businesses influenced by external investors, whose short-term objectives may not align with the company’s longer-term vision.

- Employee Navigator has been profitable since 2015. We did not need to bring in private equity partners to pay our bills and have remained focused on long-term investments supporting the success of brokers and carriers.

- When we raised money in 2021, we were able to do so on our own terms because we had a profitable business. This also meant there was no dilution of ownership. Under the right circumstances institutional partners like ours can be tremendously helpful. This contrasts with the less favorable terms often faced by companies seeking funding out of necessity due to unprofitability.

- We created a consortium to invest in Employee Navigator in 2022, made up of strategic partners. Our goal is to ensure our partners have a stake in our long-term success.

While our focus on building solid, scalable infrastructure may lack the allure of AI and other tech trends, the evidence overwhelmingly demonstrates that brokers and carriers significantly boost their earnings and enhance business retention rates with Employee Navigator. As CEO, I am committed to building a business that aligns with the long-term interests of our customers. As the son of a General Agent and former broker, I know our industry is built on hard work, humility and trust, and there are no shortcuts to success. I eagerly look forward to continuing our journey together.

George Reese, CEO

Employee Navigator